| Dana Rao | | | | | | | | | •Business strategy

| •Financial performance

| •Executive & director compensation

| •The Content Authenticity Initiative

| •Human capital and talent

| •Diversity and Inclusion programs

| •Board oversight of ESG matters

| •Renewable energy and sustainability

| •Accessibility and digital inclusionExecutive Vice President, General Counsel &

Chief Trust Officer, and Secretary |

March 1, 2024 San Jose, California

Special Note About Forward-Looking Statements In addition to historical information, this proxy statement contains “forward-looking statements” within the meaning of applicable securities laws, including statements related to product development plans and new or enhanced offerings; our business, AI and innovation momentum; market opportunity and future growth; market and AI trends; strategic investments; industry positioning; customer acquisition and retention; and our environmental, social and governance goals, commitments and strategies. When used in this proxy statement, the words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding our focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this proxy statement is based on information available to us as of the date of this proxy statement and involves risks, uncertainties and assumptions. Such risks and uncertainties, many of which relate to matters beyond our control, could cause actual results to differ materially and adversely from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section titled “Risk Factors” and elsewhere in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Adobe’s other filings with the U.S. Securities and Exchange Commission (“SEC”). Undue reliance should not be placed on the financial information set forth in this report, which reflects estimates based on information available at this time. Adobe assumes no obligation to, and does not currently intend to, update these forward-looking statements. No Incorporation By Reference This proxy statement includes several website addresses and references to additional materials and reports found on those websites. These websites, materials and reports are not incorporated by reference herein.

Table of Contents

Proxy Statement Summary

The proxy materials, which include this proxy statement, proxy card, Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) and our 2023 Annual Report on Form 10-K, are being distributed and made available on or about March 1, 2024. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the 2024 annual meeting of stockholders (“2024 Annual Meeting”). In this proxy statement, the terms “Adobe,” “we,” “our,” and “Company” refer to Adobe Inc. This summary does not contain all of the information you should consider. Please read this entire proxy statement carefully before voting.

About Adobe Changing the world through personalized digital experiences Founded in 1982, Adobe is a global technology company with a mission to change the world through personalized digital experiences. For over four decades, Adobe’s innovations have transformed how individuals, teams, businesses, enterprises, institutions, and governments engage and interact across all types of media. Our products, services and solutions are used around the world to imagine, create, manage, deliver, measure, optimize and engage with content across surfaces and fuel digital experiences. We have a diverse user base that includes consumers, communicators, creative professionals, developers, students, small and medium businesses and enterprises. We are also empowering creators by putting the power of artificial intelligence (“AI”) in their hands, and doing so in ways we believe are responsible. Our products and services help unleash creativity, accelerate document productivity and power businesses in a digital world. Fiscal Year 2023 Financial Highlights | | | | | | | | | Total Revenue ($B) ↑ 10% year-over-year growth | Digital Media Revenue ($B) ↑ 11% year-over-year growth | Digital Experience Revenue($B) ↑ 11% year-over-year growth |

| | | | | | | | | | | | | | | | GAAP Operating Income | | Non-GAAP Operating Income(1) | | Operating Cash Flows | | $6.65B | | $8.92B | | $7.3B | | GAAP Diluted EPS | | Non-GAAP Diluted EPS(1) | | Shares Repurchased | | $11.82 | | $16.07 | | 11.5M |

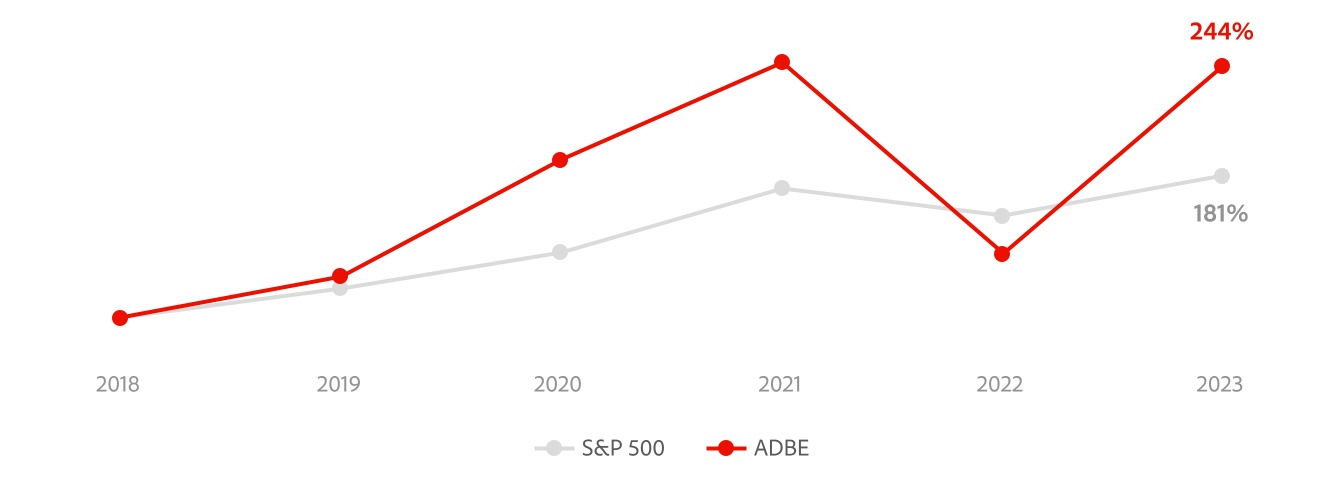

________________________ (1) See Annex A for a reconciliation of measures reported in accordance with generally accepted accounting principles in the United States (“GAAP”) to non-GAAP measures. Five-Year Stockholder Return Comparison The following graph shows the total return assuming equivalent investments on November 30, 2018 in our common stock and the S&P 500 Index, with reinvestment of dividends. For each reported year, our reported dates are the last trading dates of our fiscal year which ends on the Friday closest to November 30. 2

Director Nominees The following tables set forth the name, occupation, age, tenure, independence, committee assignments and attributes (as of March 1, 2024) for each of our twelve director nominees at the 2024 Annual Meeting. Each director is elected annually by our stockholders. See the section titled “Our Directors” for more information. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | COMMITTEE MEMBERSHIPS(1) | | Name | Occupation | Age | Director NomineesSince | Independent | Audit | Executive Compensation | Governance and Committee MembershipSustainability | Cristiano Amon The following table sets forth the name, role, age as of March 4,DIRECTOR

| President and CEO, Qualcomm | 53 | Oct 2023 | Yes | | M | | Amy Banse DIRECTOR | Partner, Mosaic General Partnership (formerly Mastry, Inc.) | 64 | May 2012 | Yes | | C | M | Brett Biggs DIRECTOR | Former EVP and CFO, Walmart | 55 | Jan 2022 tenure | Yes | M | | | Melanie Boulden DIRECTOR | Grp. President Prepared Foods & Chief Growth Officer, Tyson Foods | 51 | Oct 2020 | Yes | | M | | Frank Calderoni LEAD DIRECTOR | CEO, Velocity Global | 66 | May 2012 | Yes | | | C | Laura Desmond DIRECTOR | CEO, Smartly.io | 58 | May 2012 | Yes | | M | | Shantanu Narayen CHAIR | Chair and committee assignments for each of our twelve director nominees at theCEO, Adobe | 60 | Dec 2007 | No | | | | Spencer Neumann DIRECTOR | CFO, Netflix | 54 | Jan 2022 Annual Meeting. Each director is elected annually by our stockholders. | Yes | M | | | Kathleen Oberg | | | | | | | | | | | | | | | | | | | | | | | | | | | | | COMMITTEE MEMBERSHIPS(1) | | NAME | ROLE | AGE | DIRECTOR SINCE | INDEPENDENT | AUDIT | EXECUTIVE COMPENSATION | GOVERNANCE AND SUSTAINABILITY | | Amy Banse | Director | 62 | 2012 | Yes | | C | M | | Brett Biggs | Director | 53 | 2022 | Yes | M | | | | Melanie Boulden | Director | 49 | 2020 | Yes | | M | | | Frank Calderoni | Lead Director | 64 | 2012 | Yes | | | C | | Laura Desmond | Director | 56 | 2012 | Yes | | M | | | Shantanu Narayen | Chairman | 58 | 2007 | No | | | | | Spencer Neumann | Director | 52 | 2022 | Yes | M | | | | Kathleen Oberg | Director | 61 | 2019 | Yes | C | | M | | Dheeraj Pandey | Director | 46 | 2019 | Yes | M | | | | David Ricks | Director | 54 | 2018 | Yes | | M | | | Daniel Rosensweig | Director | 60 | 2009 | Yes | | | M | | John Warnock | Director | 81 | 1983 | Yes | | | |

| CFO and EVP, Development, Marriott International | 63 | Jan 2019 | Yes | C | | M | Dheeraj Pandey | | | | | | | | | | | | | | | C | Chair | | M | MemberDIRECTOR | Chair and CEO, DevRev | 48 | Jan 2019 | Yes | M | | | David Ricks DIRECTOR | Chair and CEO, Eli Lilly and Company | 56 | Apr 2018 | Yes | | M | | Daniel Rosensweig DIRECTOR | President, CEO, and Co-Chair, Chegg.com | 62 | Jan 2009 | Yes | | | M |

(1) If director nominees are elected by stockholders, committee composition immediately following the 2022 Annual Meeting will be unchanged.

* Excluding co-founder John Warnock, who has served on the Board since the Company’s inception, the remaining eleven nominees have an average tenure of 6.4 years.

Board Diversity Matrix (as of March 4, 2022)

| | | | | | | | | | | | | | | | | | | Total Number of Directors | 12 | | FEMALE | MALE | NON-BINARY | DID NOT DISCLOSE GENDER | | PART I: GENDER IDENTITY | | Directors | 4 | 8 | 0 | 0 | | PART II: DEMOGRAPHIC BACKGROUND | | African American or Black | 1 | 0 | 0 | 0 | | Alaskan Native or Native American | 0 | 0 | 0 | 0 | | Asian | 0 | 2 | 0 | 0 | | Hispanic or Latinx | 0 | 0 | 0 | 0 | | Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | | White | 3 | 6 | 0 | 0 | | Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | | LGBTQ+ | 1 | | Did Not Disclose Demographic Background | 0 |

| | | ________________________ (1) If director nominees are elected by stockholders, committee composition immediately following the 2024 Annual Meeting will be unchanged. Director Attributes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12 | Executive Leadership | | | 12 | Business Development & Strategy | | | 5 | Legal or Regulatory | | 12 | Global Leadership | | | 4 | Sales, Marketing & Brand Management | | | 12 | Operations | | 3 | Technologist | | | 11 | Finance or Accounting | | | 8 | Public Company Board Service / Governance |

| | | | | | | | | | | | Average Age 57 years | Average Tenure 7.6 years | Independence 92% | Directors w/ Gender or Demographic Diversity 58% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12 directors | | Executive Leadership | | 12 directors | | Operations | | 4 directors | | Sales, Marketing & Brand Management | 12 directors | | Global Leadership | | 11 directors | | Finance or Accounting | | 3 directors | | Technologist | 12 directors | | Business Development & Strategy | | 5 directors | | Legal or Regulatory | | 9 directors | | Public Company Board Service / Governance | | | | | | | | | | | |

Proxy Summary | 2024 Proxy Statement 3

Corporate Governance Highlights | | | | | | | Adobe is committed to excellence in corporate governance. We maintain numerous policies and practices that demonstrate our commitment, including those summarized below. See the section titled “Corporate Governance” for more information. •Strong board independence (11 of 12 director nominees are independent)

| •Independent lead director

| •All committee members are independent

| •All directors stand for election annually

| •Majority vote standard for uncontested director elections

| •Bylaws provide for proxy access for stockholders

| •Single class of stock with equal voting rights

| •Robust stock ownership requirements for executive officers and directors

| •Stockholder right to call a special meeting

| •All current Audit Committee members are audit committee financial experts under SEC rules

| •Simple majority vote standard for charter/bylaw amendments

| •Regular board and committee evaluations facilitated by an independent third party | | | | | | •Strong Board independence (11 of 12 director nominees are independent) | •Independent lead director | •All committee members are independent | •All directors stand for election annually | •Majority vote standard plus resignation policy for uncontested director elections | •Bylaws provide for proxy access for stockholders | •Single class of stock with equal voting rights | •Robust stock ownership requirements for executive officers and directors | •Stockholder right to call a special meeting | •All current Audit Committee members are audit committee financial experts under SEC rules | •Simple majority vote standard for charter/bylaw amendments | •Regular Board and committee evaluations facilitated by an independent third party | •Any independent director may call for a meeting in executive session | •Prohibition on transactions involving pledging, hedging or short sales of Adobe equity |

Stockholder Engagement Adobe has a history of actively engaging with our stockholders and regularly assessing our corporate governance, executive and director compensation, and sustainability practices. Our Investor Relations, Corporate Legal and environmental, social and governance (“ESG”) teams meet with investors, prospective investors and investment analysts. Meetings can include participation by our management team and, at times, our Lead Director and other members of our Board of Directors (the “Board”). Our heads of Investor Relations and Corporate Legal regularly communicate topics discussed and stockholder feedback to senior management and the Board for consideration in their decision-making. In fiscal year 2023, we have sought meetings with stockholders that collectively hold greater than 40% of our outstanding shares. Topics that we discussed with stockholders include: | | | | | | | | | •Business strategy | •Financial performance | •Executive compensation | •The Content Authenticity Initiative and AI Ethics and responsible innovation | •Human capital and talent | •Diversity, equity and Inclusion programs | •Board oversight of ESG matters | •Renewable energy and sustainability | •Board composition |

4

| | | | Executive Compensation Highlights | Say-On-Pay Results At our 2023 annual meeting of stockholders (“2023 Annual Meeting”), approximately 88% of the votes cast approved, on an advisory basis, the fiscal year 2022 compensation for our named executive officers (“NEOs”). |

Compensation PracticesDirector Nominees

The following tables set forth the name, occupation, age, tenure, independence, committee assignments and attributes (as of March 1, 2024) for each of our twelve director nominees at the 2024 Annual Meeting. Each director is elected annually by our stockholders. See the section titled “Our Directors” for more information. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | COMMITTEE MEMBERSHIPS(1) | What we doName | Occupation | What we don’t doAge | Director Since | Independent | Audit | Executive Compensation | Governance and Sustainability | üCristiano Amon DIRECTOR | President and CEO, Qualcomm | 53 | Oct 2023 | Yes | | M | | Amy Banse DIRECTOR | Partner, Mosaic General Partnership (formerly Mastry, Inc.) | 64 | May 2012 | Yes | | C | M | Brett Biggs DIRECTOR | Former EVP and CFO, Walmart | 55 | Jan 2022 | Yes | M | | | Melanie Boulden DIRECTOR | Grp. President Prepared Foods & Chief Growth Officer, Tyson Foods | 51 | Oct 2020 | Yes | | M | | Frank Calderoni LEAD DIRECTOR | CEO, Velocity Global | 66 | May 2012 | Yes | | | C | Laura Desmond DIRECTOR | CEO, Smartly.io | 58 | May 2012 | Yes | | M | | Shantanu Narayen CHAIR | Chair and CEO, Adobe | 60 | Dec 2007 | No | | | | Spencer Neumann DIRECTOR | CFO, Netflix | 54 | Jan 2022 | Yes | M | | | Kathleen Oberg DIRECTOR | CFO and EVP, Development, Marriott International | 63 | Jan 2019 | Yes | C | | M | Dheeraj Pandey DIRECTOR | Chair and CEO, DevRev | 48 | Jan 2019 | Yes | M | | | David Ricks DIRECTOR | Chair and CEO, Eli Lilly and Company | 56 | Apr 2018 | Yes | | M | | Daniel Rosensweig DIRECTOR | President, CEO, and Co-Chair, Chegg.com | 62 | Jan 2009 | Yes | | | M |

________________________ (1) If director nominees are elected by stockholders, committee composition immediately following the 2024 Annual Meeting will be unchanged. Director Attributes | | | | | | | | | | | | Average Age 57 years | PayAverage Tenure

7.6 years | Independence 92% | Directors w/ Gender or Demographic Diversity 58% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12 directors | | Executive Leadership | | 12 directors | | Operations | | 4 directors | | Sales, Marketing & Brand Management | 12 directors | | Global Leadership | | 11 directors | | Finance or Accounting | | 3 directors | | Technologist | 12 directors | | Business Development & Strategy | | 5 directors | | Legal or Regulatory | | 9 directors | | Public Company Board Service / Governance | | | | | | | | | | | |

Proxy Summary | 2024 Proxy Statement 3

Corporate Governance Highlights Adobe is committed to excellence in corporate governance. We maintain numerous policies and practices that demonstrate our commitment, including those summarized below. See the section titled “Corporate Governance” for more information. | | | | | | •Strong Board independence (11 of 12 director nominees are independent) | •Independent lead director | •All committee members are independent | •All directors stand for Performance.election annually | Our executives’ total compensation is designed to pay•Majority vote standard plus resignation policy for performance and is compriseduncontested director elections

| •Bylaws provide for proxy access for stockholders | •Single class of elements that address both short-term and long-term financial performance.stock with equal voting rights | | û | Our Insider Trading Policy, which applies to all employees,•Robust stock ownership requirements for executive officers and directors prohibits | •Stockholder right to call a special meeting | •All current Audit Committee members are audit committee financial experts under SEC rules | •Simple majority vote standard for charter/bylaw amendments | •Regular Board and committee evaluations facilitated by an independent third party | •Any independent director may call for a meeting in executive session | •Prohibition on transactions involving pledging, hedging or short sales of Adobe equity.equity |

Stockholder Engagement Adobe has a history of actively engaging with our stockholders and regularly assessing our corporate governance, executive and director compensation, and sustainability practices. Our Investor Relations, Corporate Legal and environmental, social and governance (“ESG”) teams meet with investors, prospective investors and investment analysts. Meetings can include participation by our management team and, at times, our Lead Director and other members of our Board of Directors (the “Board”). Our heads of Investor Relations and Corporate Legal regularly communicate topics discussed and stockholder feedback to senior management and the Board for consideration in their decision-making. In fiscal year 2023, we have sought meetings with stockholders that collectively hold greater than 40% of our outstanding shares. Topics that we discussed with stockholders include: | | | | | | | | | •Business strategy | •Financial performance | •Executive compensation | ü•The Content Authenticity Initiative and AI Ethics and responsible innovation | Independent Compensation Consultant.

Our Compensation Committee engages its own independent compensation consultant to advise on executive•Human capital and non-employee director compensation matters.talent

| | û | We do not provide golden parachute excise tax other than gross-up payments.•Diversity, equity and Inclusion programs | ü•Board oversight of ESG matters | Annual•Renewable energy and sustainability

| •Board composition |

4

| | | Executive Compensation Peer Group Review.Our Compensation Committee reviews the composition of our compensation peer group annually and makes adjustments to the composition of that peer group, if deemed appropriate.

| | û | We do not provide defined benefit pension plans, supplemental executive retirement plans or retiree health benefits.Highlights | ü | Say-On-Pay Results At our 2023 annual meeting of stockholders (“2023 Annual Say-on-Pay Vote. We conductMeeting”), approximately 88% of the votes cast approved, on an annual advisory vote onbasis, the fiscal year 2022 compensation offor our named executive officers (“NEOs”).

| | û | Our equity plans do not include an evergreen feature that would automatically replenish the shares available for issuance. | ü | Fully Independent Compensation Committee.

Our Compensation Committee is comprised of 100% independent directors.

| | | | ü | Clawback Policy.

We have a clawback policy for performance-based incentive compensation of our executive officers.

| | | | ü | Robust Stock Ownership Guidelines.

We have robust stock ownership requirements for our directors and officers at the senior vice president level and above.

| | | |

Target Pay Mix for Named Executive Officers

Environmental, Social and Governance

At Adobe, our belief in corporate citizenship permeates nearly everything we do. As we’ve grown in our technical innovation, we’ve put a similar priority in growing our social impact, making environmental, social and governance (“ESG”) performance an integral feature of our business operations.

We’re proud to be able to say that the industry has taken notice: Adobe’s ESG efforts have earned us recognition as one of JUST Capital’s Top 25 Just Companies, one of Fortune’s Great Places to Work and one of the leaders in the Dow Jones Sustainability Index.

The highlights and updates presented below are for fiscal year 2021, unless otherwise stated.

Sustainability

| | | | | | | | | We’ve made sustainability a priority since Adobe’s inception. We strive to improve our energy efficiency and achieve a zero-carbon operational footprint; develop digital products designed to enhance the sustainability initiatives of employees and customers; and work with peers, partner organizations and our own internal teams and employees to foster a culture of sustainability throughout our business and beyond. | | Continued progress towards goal of powering 100% of our operations with renewable energy by 2035 | through enrollment in a green tariff program for our Oregon data center that will provide renewable electricity from a new solar facility in Oregon starting in 2022 | | Raised our Science-Based Targets (“SBTs”) to “well-below 1.5°C” | —the most ambitious designation available through the SBT process | | Rethinking real estate footprint | and optimizing building management as employees return to offices |

Additional information is available at http://www.adobe.com/corporate-responsibility/sustainability.html.

Diversity and Inclusion

| | | | | | | | | Adobe For All is our vision to advance diversity & inclusion across our company. We believe that when people feel appreciated and included, they can be more creative, innovative and successful. In 2021 we made progress across our four-pronged strategy by (1) inspiring youth to pursue technology careers; (2) attracting diverse talent and maintaining fair hiring; (3) creating an inclusive workplace for employees; and (4) joining forces with industry partners.

Overall, our diverse representation has been moving in a positive direction year over year. That said, we still have work ahead of us to increase diverse representation at Adobe and reach our aspirational goals.

| | Achieved global gender and U.S. URM(1)/non-URM pay parity

| again in fiscal year 2021 | | Set aspirational goal to increase representation of women to 30% and double URM(1) representation

| in leadership positions by 2025 | | Set aspirational goal to double Black representation | as a percentage of US employees by 2025 | | 8 employee resource groups | that build community for employees from underrepresented groups | | Global employee allyship program | | Continued investment in the Taking Action Initiative | to accelerate the representation and success of Black and underrepresented employees |

Additional information on our diversity efforts are available at http://www.adobe.com/diversity.

(1) Adobe defines URMs as employees who identify as Black/African American, Hispanic/Latinx, Native American, Pacific Islander and/or two or more races.

Philanthropy

| | | | | | | | | We’ve put a priority on philanthropy as a means of supporting and empowering the communities in which we live and work. In a continued effort to invest in communities that are supporting racial and social justice globally, last fall we launched our first ever Equity and Advancement Initiative. This unique approach to long-term, global commitments has positioned us to make an extensive impact with select NGOs and enabled us to develop deeper collaborations and partnerships aligned with our employee networks. We also continue to support students around the globe pursuing careers in creativity and design through our robust scholarship programs.

| | Supporting 11 leading racial and social justice organizations, including Equality Now and Human Rights Watch | through our Equity Advancement Initiative via the Adobe Foundation | | Committing an additional $9.5M | to social equity and advancement | | Investing $9.35M in grants and scholarships | centered on technology + creativity skill-building for students | | Partnering with Khan Academy | to bring content and creative activities to millions of students and teachers | | $8.1M to support COVID relief efforts | for emergency housing, food, healthcare, and K-12 education |

Employee Engagement

| | | | | | | | | Our commitment to corporate citizenship begins with the people who make Adobe great: our people. In 2021, nearly 7 in 10 of Adobe’s global employees participated in employee engagement impact efforts, including employee matching grants, the Employee Community Fund, nonprofit board service and volunteerism.

| | $15.5M donations matched | from Adobe employees for causes | | $5M given to 250 nonprofits by 10,500 employees | through our Employee Community Fund, a locally-driven grantmaking program | | 127,000 volunteer hours | from roughly a third of our employees globally |

Technology to Transform

| | | | | | | | | | | | | | | We’re focused on how our tools, technology and platform can make the world a better place. Our solutions are creating positive change in powerful ways around the world, from combating digital illiteracy to significantly reducing environmental waste. Adobe is committed to the responsible use of technology, leading by operating our business sustainably and ensuring that the innovations we create and bring to market are ethical, trustworthy and positively contributing to society. | | | | | We established the Content Authenticity Initiative (“CAI”) with the goal of increasing trust and transparency online through an industry-wide attribution toolthat empowers creatives and consumers alike. The CAI, which has now garnered more than 500 members, is helping creators get credit for their work and empowering consumers to evaluate the validity of digital media content.

| | | | #1 in Computer Software for driving digital government processes during the pandemic.

|

Governance and ESG Oversight

We leverage our governance structure to help ensure that our sustainability efforts are coordinated across all areas of our business. Our Governance and Sustainability Committee has primary oversight responsibility for ESG, and our Executive Compensation Committee oversees human capital management. Our management provides regular updates to the Board on various ESG matters, including diversity and inclusion, and regular updates on cybersecurity and privacy to the Audit Committee. In addition to oversight by the committees of our Board, our Sustainability Committee, a global-cross function group of individuals, reviews and guides strategies and proposes action plans and performance objectives related to our company-wide sustainability efforts.

Board of Directors &

Corporate Governance

Our Board of Directors

Our business is managed under the direction of our Board, which is currently composed of twelve members. Adobe’s stockholders elect our Board members annually. Except for Messrs. Biggs and Neumann, who joined our Board in January 2022, all of our current directors were elected by our stockholders, and all directors are serving a term that expires at the 2022 Annual Meeting. See the “Proxy Summary—Board Highlights” section for information on the composition of our Board.

The following table highlights the number of our director nominees who share certain categories of attributes and experiences that uniquely qualify them to serve on our Board. We believe the diversity of experiences and qualifications represented by our directors is critical to Adobe’s success. We have narrowly tailored and defined these categories, although inclusion in certain categories will in many cases provide experience and expertise covered by other categories. For example, directors with CEO experience will also have gained significant exposure to operational and regulatory issues.

| | | | | | | | | | | | Attributes and Experience of Director Nominees | | 12 | Executive Leadership | Directors who have served as a founder, CEO or CEO-equivalent, senior executive or business unit leader of a company with a deep understanding of company offerings and industry | | 12 | Global Leadership | Directors with leadership experience in a global company overseeing non-U.S. operations, diverse economic landscapes and working with various cultures | | 12 | Business Development & Strategy | Directors with expertise in strategic planning, mergers and acquisitions, growth strategies or business expansion | | 3 | Technologist | Directors with extensive experience in software products, services, engineering or development, computer science, information technology, cybersecurity or technology research and development | | 4 | Sales, Marketing & Brand Management | Directors with specific and extensive career experience focusing on sales management, marketing campaign management, marketing/advertising products and services or public relations | | 11 | Finance or Accounting | Directors with a deep understanding of finance, accounting principles and methodologies, financial reporting, financial management, capital markets, financial statements, audit processes and procedures or internal financial controls | | 5 | Legal or Regulatory | Directors with governmental policy, legal knowledge or experience with compliance and regulatory issues within a public company or a regulatory body, including any individual who has a CPA, JD or significant CFO experience | | 12 | Operations | Directors having expertise in business operations management, supply chain management, integration or distribution | | 8 | Public Company Board Service / Governance | Directors who currently serve, or have served, on other public company boards |

Considerations in Evaluating Director Nominees

The Board identified the following general criteria for consideration when evaluating board member nominees and composition of the Board:

•Exercises logical, thorough, objective, sound and rational judgment when representing the best interests of all Adobe stockholders

•Possesses experience and expertise relevant to expanding the breadth of the Board’s collective knowledge, skill set and attributes

•Demonstrates commitment to achieving Adobe’s long-term objectives by prioritizing and investing the attention necessary to fulfill Board membership-related duties, attendance obligations and responsibilities

•Maintains and increases diversity in professional experience, personal experience, expertise, culture, race, ethnicity and/or gender among the Board members

•Understands elements relevant to the success of a publicly-traded company, including the importance of best practices in corporate governance

•Demonstrates integrity and ethics in such nominee’s personal and professional life

Director Nominees The following tables set forth the name, occupation, age, tenure, independence, committee assignments and attributes (as of March 1, 2024) for Electioneach of our twelve director nominees at the 2024 Annual Meeting. Each director is elected annually by our stockholders. See the section titled “Our Directors” for a One-Year Term Expiring in 2023more information. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | COMMITTEE MEMBERSHIPS(1) | | Name | Occupation | Age | Director Since | Independent | Audit | Executive Compensation | Governance and Sustainability | Cristiano Amon DIRECTOR | President and CEO, Qualcomm | 53 | Oct 2023 | Yes | | M | | Amy Banse DIRECTOR | Partner, Mosaic General Partnership (formerly Mastry, Inc.) | 64 | May 2012 | Yes | | C | M | Brett Biggs DIRECTOR | Former EVP and CFO, Walmart | 55 | Jan 2022 | Yes | M | | | Melanie Boulden DIRECTOR | Grp. President Prepared Foods & Chief Growth Officer, Tyson Foods | 51 | Oct 2020 | Yes | | M | | Frank Calderoni LEAD DIRECTOR | CEO, Velocity Global | 66 | May 2012 | Yes | | | C | Laura Desmond DIRECTOR | CEO, Smartly.io | 58 | May 2012 | Yes | | M | | Shantanu Narayen CHAIR | Chair and CEO, Adobe | 60 | Dec 2007 | No | | | | Spencer Neumann DIRECTOR | CFO, Netflix | 54 | Jan 2022 | Yes | M | | | Kathleen Oberg DIRECTOR | CFO and EVP, Development, Marriott International | 63 | Jan 2019 | Yes | C | | M | Dheeraj Pandey DIRECTOR | Chair and CEO, DevRev | 48 | Jan 2019 | Yes | M | | | David Ricks DIRECTOR | Chair and CEO, Eli Lilly and Company | 56 | Apr 2018 | Yes | | M | | Daniel Rosensweig DIRECTOR | President, CEO, and Co-Chair, Chegg.com | 62 | Jan 2009 | Yes | | | M |

________________________

(1) If director nominees are elected by stockholders, committee composition immediately following the 2024 Annual Meeting will be unchanged. Director Attributes | | | | | | | | | | | | Amy Banse | |  Age: 62

Director since 2012.

Other Public Company Boards:

The Clorox Company

Lennar Corporation

On Holding AG57 years

| Average Tenure 7.6 years | Committees: Executive Compensation (chair), Governance and SustainabilityIndependence

| | | | 92% | Biography:Directors w/ Gender or Demographic Diversity

Ms. Banse is currently a partner at Mastry, Inc., an early stage venture capital firm. Previously, she held several roles at Comcast Corporation (“Comcast”), a global media and technology company, including Executive Vice President, Comcast Corporation, and Managing Director and Head of Funds, Comcast Ventures. Prior to that role, Ms. Banse was President of Comcast Interactive Media (“CIM”), a division of Comcast responsible for developing Comcast's online strategy and operating Comcast's digital properties, including Xfinity.com and Xfinitytv.com. She joined Comcast in 1991 and spent the early part of her career at Comcast overseeing the development of Comcast's cable network portfolio. She received a B.A. from Harvard and a JD from Temple University School of Law.

As the former Managing Director and Head of Funds for Comcast Ventures and Executive Vice President, Comcast Corporation, as well as her prior executive positions, including President of CIM, Ms. Banse has extensive executive leadership experience and extensive knowledge of financial and strategic issues. She also brings to the Board a deep expertise in global media and technology organizations in online business.58%

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Brett Biggs12 directors | | Executive Leadership | |  directors | | Operations | | 4 directors | | Sales, Marketing & Brand Management |  Age: 53

Director since 2022.directors

| | Global Leadership | | Committees: Audit11

directors | | Finance or Accounting | | 3 directors | | Technologist | 12 directors | | Business Development & Strategy | | 5 directors | | Legal or Regulatory | | 9 directors | | Public Company Board Service / Governance | | | Biography:

Mr. Biggs currently serves as the Executive Vice President and Chief Financial Officer for Walmart Inc. Prior to his current role, Mr. Biggs held the roles of Chief Financial Officer for Walmart International, Walmart U.S. and Sam’s Club. Mr. Biggs also served as Senior Vice President for International Strategy, Mergers and Acquisitions and as Senior Vice President of Corporate Finance, as well as Senior Vice President of Operations for Sam’s Club. Before joining Walmart in 2000, Mr. Biggs held various M&A and corporate finance positions at Leggett & Platt, Phillips Petroleum Co. and Price Waterhouse. He holds a bachelor’s degree in accounting from Harding University and an MBA with Honors from Oklahoma State University.

With his current role as Executive Vice President and Chief Financial Officer for Walmart, as well as his prior executive positions, Mr. Biggs brings to the Board extensive executive experience and financial expertise, including in-depth knowledge of the complex financial and operational issues facing large global companies and understanding of accounting principles and financial reporting rules and regulations.

| | | | | | | | |

2022Proxy Summary | 2024 Proxy Statement |93

Adobe is committed to excellence in corporate governance. We maintain numerous policies and practices that demonstrate our commitment, including those summarized below. See the section titled “Corporate Governance” for more information.

| | | | | | | | | | | | Melanie Boulden•Strong Board independence (11 of 12 director nominees are independent) |  | Age: 49

Director since 2020.•All committee members are independent

| | Committees: Executive Compensation•All directors stand for election annually

| •Majority vote standard plus resignation policy for uncontested director elections | | •Bylaws provide for proxy access for stockholders | •Single class of stock with equal voting rights | Biography:•Robust stock ownership requirements for executive officers and directors

| Ms. Boulden currently serves as Chief Marketing Officer of the Coca-Cola North America Operating Unit (“NAOU”) responsible•Stockholder right to call a special meeting

| •All current Audit Committee members are audit committee financial experts under SEC rules | •Simple majority vote standard for charter/bylaw amendments | •Regular Board and committee evaluations facilitated by an independent third party | •Any independent director may call for a multibillion dollar brand portfolio consistingmeeting in executive session | •Prohibition on transactions involving pledging, hedging or short sales of 20+ brands including Coca-Cola, Sprite, Smartwater, Minute Maid and Simply. Prior to her role as Chief Marketing Officer, Ms. Boulden was President of the Stills Business Unit and led NAOU’s water, active hydration, tea and coffee businesses. Before joining Coca-Cola in 2019, Ms. Boulden was the global head of Marketing and Brand Management at Reebok, where she reignited Reebok’s connection to pop culture, entertainment, fitness and fashion. She also served as Senior Vice President of Global Marketing at Crayola and spent several years at Kraft Foods and Henkel Consumer Goods in various marketing and general management positions. Ms. Boulden holds a B.S. from Iowa State University and an MBA from The University of Iowa. With her current role as Chief Marketing Officer of NAOU, together with her previous roles managing some of the world’s most well-known brands, Ms. Boulden brings to the Board extensive experience and deep expertise in global marketing and brand management.Adobe equity

|

Stockholder Engagement Adobe has a history of actively engaging with our stockholders and regularly assessing our corporate governance, executive and director compensation, and sustainability practices. Our Investor Relations, Corporate Legal and environmental, social and governance (“ESG”) teams meet with investors, prospective investors and investment analysts. Meetings can include participation by our management team and, at times, our Lead Director and other members of our Board of Directors (the “Board”). Our heads of Investor Relations and Corporate Legal regularly communicate topics discussed and stockholder feedback to senior management and the Board for consideration in their decision-making. In fiscal year 2023, we have sought meetings with stockholders that collectively hold greater than 40% of our outstanding shares. Topics that we discussed with stockholders include: | | | | | | | | | | | | Frank Calderoni Lead Director•Business strategy

|  | •Executive compensation | Age: 64

Director since 2012.

Lead Director since 2020.

Other Public Company Boards:

Anaplan, Inc.

Palo Alto Networks, Inc. (2016 to 2019)•The Content Authenticity Initiative and AI Ethics and responsible innovation

| •Human capital and talent | Committees: Governance•Diversity, equity and Sustainability (chair)Inclusion programs

| | | | •Board oversight of ESG matters | Biography:

Mr. Calderoni currently serves as the President•Renewable energy and Chief Executive Officer of Anaplan, Inc., a planning and performance management platform provider. Prior to joining Anaplan in January 2017, he served as Executive Vice President, Operations and Chief Financial Officer at Red Hat, Inc. from June 2015 to December 2016. Until June 2015, he was an Executive Advisor at Cisco Systems, Inc., a designer, manufacturer and seller of IP-based networking and other products related to the communications and information technology industry. From 2008 to January 2015, Mr. Calderoni served as Executive Vice President and Chief Financial Officer at Cisco, managing the company's financial strategy and operations. He joined Cisco in 2004 from QLogic Corporation, a storage networking company where he was Senior Vice President and Chief Financial Officer. Prior to that, he was Senior Vice President, Finance and Administration and Chief Financial Officer for SanDisk Corporation, a flash data storage company. Before joining SanDisk, Mr. Calderoni spent 21 years at IBM, a global services, software and systems company, where he became Vice President and held controller responsibilities for several divisions within the company. Mr. Calderoni holds a B.S. in Accounting and Finance from Fordham University and an MBA in Finance from Pace University.sustainability

| As a result of his position at Anaplan, as well as his past service as chief financial officer of publicly traded global technology companies, Mr. Calderoni brings to the •Board abundant financial expertise that includes extensive knowledge of the complex financial and operational issues facing large global companies and a deep understanding of accounting principles and financial reporting rules and regulations. He provides the Board with significant insight into the preparation of financial statements and knowledge of audit procedures.Through his senior executive positions, Mr. Calderoni has demonstrated his global leadership and business acumen.composition

|

10| Adobe Inc.4

| | | | Executive Compensation Highlights | Say-On-Pay Results At our 2023 annual meeting of stockholders (“2023 Annual Meeting”), approximately 88% of the votes cast approved, on an advisory basis, the fiscal year 2022 compensation for our named executive officers (“NEOs”). |

Compensation Practices

| | | | | | | | | | | | | | | | What we do | | | | | | | | | | | What we don’t do | Laura Desmondü | Our NEOs’ total compensation is designed to pay for performance and is comprised of elements that address both short-term and long-term financial performance, with appropriate caps on maximum amounts payable. | û | Our Insider Trading Policy, which applies to all employees, officers and directors, prohibits transactions involving pledging, hedging or short sales of Adobe equity. | | ü | Our Executive Compensation Committee engages its own independent compensation consultant to advise on executive and non-employee director compensation matters. | û | We do not provide golden parachute excise tax gross-up payments. | | ü | Our Executive Compensation Committee reviews the composition of our compensation peer group annually and makes adjustments to that composition, if deemed appropriate. | û | We do not provide defined benefit pension plans, supplemental executive retirement plans or retiree health benefits for our executive officers. | | ü | We conduct an annual advisory vote on the compensation of our NEOs. | û | Our equity plans do not include an evergreen feature that would automatically replenish the shares available for issuance. | | ü | Our Executive Compensation Committee is comprised 100% of independent directors and “non-employee directors” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). | | | ü | We have clawback policies for performance-based incentive compensation of our executive officers. | | ü | We have robust stock ownership requirements for executive officers and directors. | | | | | |

CEO and All Other NEOs’ Target Pay Mix for Fiscal Year 2023(1) ________________________ (1) The amounts shown for all other NEOs represent their average target pay mix. See the section titled “Executive Compensation—Compensation Discussion and Analysis” for more information. Proxy Summary | 2024 Proxy Statement 5

Environmental, Social and Governance Adobe’s commitment to doing the right thing by focusing on people, purpose and community dates back to our founding. This commitment has guided our evolution and growth and inspires our employees to create the future and change the world for the better. Our ESG priorities inform how we run the business and engage our employees, customers, business partners and communities. We are proud of the industry recognition we continue to receive, including being named to JUST Capital’s Top 50 Just Companies, Fortune’s Great Places to Work and Wall Street Journal’s 250 Best-Managed Companies of 2023 lists. We have also been recognized in the 2023 Bloomberg Gender-Equality Index, Forbes’ Net Zero Leaders list and the Dow Jones Sustainability Index. There are three key areas in which we are uniquely positioned and motivated to make a difference by harnessing the best of our people, product and philanthropy: Adobe for All, Creativity for All and Technology to Transform. The updates below are for fiscal year 2023, unless otherwise stated. Adobe for All Adobe for All is our commitment to advance diversity, equity and inclusion (“DEI”) across Adobe and in our communities. We believe that when people feel respected and included, they can be more creative, innovative and successful. In 2023, we continued to build a more diverse workforce, foster an inclusive workplace and mobilize our ecosystem of industry peers and non-profit organizations worldwide to make an impact outside the Company. | | | | | | | | | | | | | Continued our commitment to fair compensation practices(1) We invest in analysis, transparency and process improvements to demonstrate our commitment to fair compensation. We review pay twice a year in connection with our rewards process and as part of an annual pay review. For 2023, we maintained global gender pay parity and in the U.S., our URM employees earned 99.35 cents for every dollar earned by U.S. non-URM employees. | | | | Reached 35.3% of women in our global employee base and 11.6% of URMs(1) in our U.S. employee base | | Granted an additional $3M to three Historically Black Colleges and Universities and Hispanic-Serving Institutions | | | | Funded an additional $10M to continue to foster racial and social justice worldwide, | | | to address educational inequities, democratize digital and creative literacy as essential 21st century skills, and advance diversity in the technology and creative talent pipeline— bringing our total multi-year grants to these schools to $9M. | | through the Adobe Foundation, and to support the Equity Advancement Initiative, a cohort of 11 international and U.S. nonprofits. | | |

(1) Taking into consideration job and location. We define URMs as employees who identify as Black/African American, Hispanic/Latinx, Native American, Pacific Islander and/or two or more races. Creativity for All Through Creativity for All, we are empowering millions of creators of all ages and backgrounds to access the tools, skills and platforms needed to express themselves, reach their full potential and share their diverse perspectives with the world. From supporting underrepresented creators by providing platforms to amplify their work and mentorship with industry leaders through our Diverse Voices program, to the hundreds of creators we have supported financially through our Adobe Creative Residency Community Fund, we are enabling people around the world to tell their stories. We are supporting digital literacy and creativity and student success by offering K-12 schools free access to Adobe Express for Education and engaging with college students across more than 55 designated Adobe Creative Campuses in the U.S. and internationally. | | | | | | | | | | Launched Adobe x Museums, a Creative Residency program with a $4.1M grant | | Published “The Inclusion List”, a first-of-its-kind list identifying top films, distributors and producers | | from Adobe Foundation to provide greater access and opportunity for creators from underrepresented communities to work with London’s Victoria and Albert Museum and New York’s Museum of Modern Art. | | driving inclusive hiring practices on and off the camera in film, in collaboration with the USC Annenberg Inclusion Initiative and Adobe Foundation. | | | | Promoted creative learning across India for 96,000 children and youth, | | | | Continued to provide Adobe Express for free to over 10M nonprofits around the world | | | ages 10 to 25 in 10,000 villages, by supporting the expansion of the India Creative Clubs. | | to help them engage donors and drive greater impact. | |

Technology to Transform Technology to Transform represents our commitment to innovating responsibly, advancing the responsible use of technology for the good of society and ensuring that our technologies drive a positive impact on the environment and in our communities. We uphold this commitment through our work on AI ethics, security, privacy, trust and safety, accessibility and sustainability. 6

As we harness the power of AI, Adobe is committed to combining technology leadership with responsible innovation. Guided by our principles of accountability, responsibility and transparency, we have implemented a comprehensive AI ethics program that includes training, testing and review by our AI Ethics Committee and Review Board, a cross-functional group of individuals from product, legal, marketing and more. Adobe’s AI-powered tools and features go through a multi-part review process to help ensure that we are developing AI in an ethical, responsible and inclusive way. Established in 2019, Adobe leads the Content Authenticity Initiative (“CAI”), a global, cross-industry coalition whose goal is to combat misinformation and restore trust online through provenance. The CAI now counts more than 2,000 members. As part of CAI, we are building on an open standard developed by the Coalition for Content Provenance and Authenticity to develop Content Credentials, a digital nutrition label for content that can show information such as a creator’s name, the date a piece of content was created, and any edits that were made to it. Content Credentials can also show whether AI was used and—more importantly—how it was used. Adobe has incorporated Content Credentials into Adobe tools and features, like Photoshop, Lightroom and Firefly, and other CAI members have begun implementing this technology into their tools and platforms. Furthermore, Adobe advocated for the inclusion of provenance and AI-labeling in policy and legislation such as in the White House Executive Order on Safe, Secure and Trustworthy AI and in the European Union’s AI Act. As we continue to incorporate AI across our products, Adobe is committed to taking important steps to help creators protect their work across the digital ecosystem and to benefit from this technology. We trained our Adobe Firefly creative generative AI family of models only on licensed images from Adobe Stock, openly licensed content, and public domain content where the copyright has expired. Beyond our own model, Adobe is working to enable creators to attach a “Do Not Train” tag to the metadata of their work, leveraging Content Credentials. We are working to drive adoption of an industry standard for this technology to give creators the option to keep their content out of AI training datasets if they choose. In addition, Adobe is advocating for a new federal anti-impersonation right to protect artists from people misusing AI tools to intentionally impersonate their style for commercial gain. Sustainability at Scale We are enabling sustainability across industries by reducing our global operational impact on the planet, developing digital products that enable our customers and communities to reduce physical waste and cut emissions, and working with our peers, partners and employees to foster a culture of sustainability. | | | | | | | | | | Declared a net zero by 2050 target | | Continued to optimize our AI architecture and minimize the amount of energy required for training and using generative AI | | and interim targets to limit global warming to 1.5°C. | by investing in code optimization, minimizing redundant steps, avoiding unnecessary content generation, and implementing efficient scheduling and batching strategies. |

Employee Engagement(1) We have always believed that people are our greatest asset. Our employees across 28 countries bring our mission to life, working together to create change in the communities where we live and work through employee matching grants, the Employee Community Fund, nonprofit board service, pro bono, volunteerism and humanitarian response efforts. | | | | | | | | | | Launched our Hometown Commitment, | | Volunteered 200,000+ hours and provided more than $33M | | a holistic approach encompassing employee engagement, volunteerism and advocacy along with product donations and $3.8M in Adobe Foundation funding, to support 11 San Jose nonprofit organizations working to solve critical local issues, revitalize the community and ensure robust cultural institutions. | in employee donations and corporate grants and matches to 10,500+ organizations globally. | | | | Directed $6M into the communities surrounding our 26 largest offices worldwide through 300 Employee Community Fund grants | |

(1) Employee engagement data represents performance in calendar year 2023. Governance and ESG Oversight We leverage our governance structure to coordinate and advance our ESG efforts across all areas of our business. Our Governance and Sustainability Committee has primary oversight responsibility for ESG and our Executive Compensation Committee oversees human capital management (“HCM”). Our leadership provides regular updates to the Board and its committees on various ESG matters, including DEI, climate action, AI and ESG disclosures, compliance requirements and risks. In addition, our ESG Committee, a global cross-functional leadership group, ensures company-wide coordination on present and emerging ESG issues. Our Sustainability Leadership Council, a cross-functional group of individuals overseen by an executive council, reviews and guides strategies and proposes action plans and performance objectives related to our company-wide sustainability efforts. Proxy Summary | 2024 Proxy Statement 7

Corporate Governance

| | | | | | | | | | Age: 56

Director since 2012.

Other Public Company Boards:

DoubleVerify Holdings Inc.

Capgemini SE (2019 to 2020)

| | Committees: Executive Compensation

| | | | | Biography:

Ms. Desmond is currently FounderBoard Responsibilities and Chief Executive Officer of Eagle Vista Partners, a strategic advisory and investment firm focused on marketing and digital technology, and an Operating Partner in the Media & Technology Practice at Providence Equity Partners L.L.C., a private equity investment firm. Prior to this, she was the Chief Revenue Officer of Publicis Groupe, a group of global marketing, communication and business transformation companies from December 2016 to December 2017. From 2008 to December 2016 she was the Global Chief Executive Officer of Starcom MediaVest Group (“SMG”), a global marketing and media services company which is part of the Publicis Groupe. Prior to her appointment as Global Chief Executive Officer in 2008, Ms. Desmond was Chief Executive Officer of SMG - The Americas from 2007 to 2008 where she managed a network spanning the United States, Canada and Latin America. She was Chief Executive Officer of MediaVest, based in New York, from 2003 to 2007, and from 2000 to 2002 she was Chief Executive Officer of SMG's Latin America group. She holds a B.B.A. in Marketing from the University of Iowa.With her extensive experience as a strategist, consultant and investor working with global marketers, media companies and brands, including serving as Chief Revenue Officer of Publicis Groupe and Global Chief Executive Officer of SMG, Ms. Desmond brings to the Board a deep expertise in global media and marketing technology organizations, leadership capabilities and business acumen. In addition, her present and past service on other boards gives her valuable knowledge and perspective. As an expert in the marketing space, Ms. Desmond speaks frequently with Adobe’s management outside of scheduled board meetings to provide specific insight regarding Adobe’s Digital Experience business.

|

| | | | | | | | | | | | Shantanu Narayen ChairmanStructure

| | Age: 58

Director since 2007.

Chairman since 2017.

Other Public Company Boards:

| | | | | | | Biography:

Mr. Narayen currently serves as our Chief Executive Officer and Chairman of the Board. He joined Adobe in January 1998 as Vice President and General Manager of our engineering technology group. In January 1999, he was promoted to Senior Vice President, Worldwide Products, and in March 2001 he was promoted to Executive Vice President, Worldwide Product Marketing and Development. In January 2005, Mr. Narayen was promoted to President and Chief Operating Officer, and effective December 2007, he was appointed our Chief Executive Officer and joined our Board. In January 2017, he was named our Chairman of the Board. Mr. Narayen holds a B.S. in Electronics Engineering from Osmania University in India, an M.S. in Computer Science from Bowling Green State University and an MBA from the Haas School of Business, University of California, Berkeley.

| | | | | | | | | | | | | |

| | | | | | | | | | | | Spencer Neumann | | Age: 52

Director since 2022.

| | Committees: Audit

| | | | | Biography:

Mr. Neumann currently serves as the Chief Financial Officer for Netflix, Inc. Before joining Netflix in January 2019, Mr. Neumann served as Chief Financial Officer for Activision Blizzard, Inc. and previously held roles at The Walt Disney Company, including Chief Financial Officer and Executive Vice President of Global Guest Experience for Walt Disney Parks and Resorts. Prior to that, he held roles at Providence Equity Partners and Summit Partners. He holds a B.A. in Economics and an MBA from Harvard University.

As a result of his position at Netflix, as well as his previous executive positions, Mr. Neumann brings to the Board extensive experience and financial expertise, including an in-depth knowledge of the complex financial and operational issues facing large global companies and a deep understanding of accounting principles and financial reporting rules and regulations.

|

| | | | | | | | | | | | Kathleen Oberg | | Age: 61

Director since 2019.

| | Committees: Audit (chair), Governance and Sustainability

| | | | | Biography:

Ms. Oberg currently serves as Chief Financial Officer and Executive Vice President, Business Operations for Marriott International, Inc. Beginning in 2013 and until January 2016, Ms. Oberg served as Chief Financial Officer for The Ritz-Carlton Hotel Company, L.L.C. From 2008 until she joined Ritz-Carlton in 2013, Ms. Oberg served as Marriott’s Senior Vice President, Corporate Development Finance and from 2006 to 2008, she served as Marriott’s Senior Vice President, International Project Finance and Asset Management for Europe, the Middle East and Africa, and as the senior finance executive for the region. Ms. Oberg’s career with Marriott began in 1999 where she served as a member of its Investor Relations group. Prior to initially joining Marriott in 1999, Ms. Oberg held various financial leadership positions with Sodexo, Sallie Mae Bank, The Goldman Sachs Group, Inc. and The Chase Manhattan Bank. Ms. Oberg holds a B.S. in Commerce with concentrations in Finance/Management Information Systems from the University of Virginia, McIntire School of Commerce and an MBA from the Stanford University Graduate School of Business.

As a result of her position at Marriott and her past service in financial leadership positions, Ms. Oberg brings to the Board financial expertise, including an in-depth knowledge of financial reporting rules and regulations and accounting principles. Her deep understanding of the multifaceted financial and operational issues affecting large global organizations and leadership experience with development projects and merger and acquisition opportunities brings the Board and Audit Committee valuable insight into preparing long-range plans, annual budgets and capital allocation strategy.

|

| | | | | | | | | | | | Dheeraj Pandey | | Age: 46

Director since 2019.

Other Public Company Boards:

Nutanix, Inc. (2009 to 2020)

| | Committees: Audit

| | | | | Biography:

Mr. Pandey is the Chairman and Chief Executive Officer of DevRev, Inc., a SaaS company that is focused on using AI and design to automate software and customer engineering workflows. Previously, he co-founded Nutanix, Inc. in 2009 and served as its Chief Executive Officer and as the Chairman of its board of directors until December 2020. Mr. Pandey also served as the President of Nutanix, Inc. from September 2009 until February 2016. Between September 2007 and September 2009, he served as VP (and Director) of Engineering at Aster Data Systems, Inc. (later acquired by Teradata Corporation), a data warehousing company. Prior to Teradata, Mr. Pandey served in software engineering roles at Oracle Corporation, Zambeel, Inc., and Trilogy Software, Inc. Mr. Pandey holds a Bachelor of Technology in Computer Science from the Indian Institute of Technology, Kanpur and a M.S. in Computer Science from the University of Texas at Austin. He was a Graduate Fellow of Computer Science in the University of Texas at Austin Ph.D. program.

With his experience in the technology industry as a global executive leader and technologist, including co-founding and serving as Chief Executive Officer and Chairman of DevRev, Inc. and Nutanix, Inc. and as a software engineer at various companies over the course of nearly 20 years, Mr. Pandey brings to the Board engineering expertise, financial acumen, an in-depth understanding of the technology landscape and valuable insight on growing a company from a start-up to a publicly traded company.

|

| | | | | | | | | | | | David Ricks | | Age: 54

Director since 2018.

Other Public Company Boards:

Eli Lilly and Company (Chair)

Elanco Animal Health, Inc. (2018 to 2019)

| | Committees: Executive Compensation

| | | | | Biography:

Mr. Ricks currently serves as Chief Executive Officer of Eli Lilly and Company and became Chair of the Eli Lilly and Company board of directors in June 2017. Prior to January 2017, Mr. Ricks served as President of Lilly Bio-Medicines. From 2009 to 2012, he served as President of Lilly USA, LLC, Eli Lilly and Company’s largest affiliate. Mr. Ricks served as President and General Manager of Lilly China, operating in one of the world’s fastest-growing emerging markets, from 2008 to 2009. He was general manager of Lilly Canada from 2005 to 2008, after roles as Director of Pharmaceutical Marketing and National Sales Director in Canada. Mr. Ricks joined Eli Lilly and Company in 1996 as a Business Development Associate and held several management roles in U.S. marketing and sales before moving to Lilly Canada. Mr. Ricks earned a B.S. from Purdue University in 1990 and an MBA from Indiana University in 1996.

As Chair and Chief Executive Officer of a large, innovation-focused, global company, Mr. Ricks brings to the Board executive leadership, marketing, sales and financial expertise, business acumen and relevant worldwide operational insight.

|

| | | | | | | | | | | | Daniel Rosensweig | | Age: 60

Director since 2009.

Other Public Company Boards:

Chegg, Inc.

Rent the Runway

Time Inc. (2017 to 2018)

| | Committees: Governance and Sustainability

| | | | | Biography:

Mr. Rosensweig is currently President, Chief Executive Officer and Chairman of the board of directors of Chegg.com, an online textbook rental company. Prior to joining Chegg.com in February 2010, Mr. Rosensweig served as President and Chief Executive Officer of RedOctane, a business unit of Activision Publishing, Inc., a developer, publisher and distributor of interactive entertainment and leisure products. Prior to joining RedOctane in March 2009, Mr. Rosensweig was an Operating Principal at the Quadrangle Group LLC, a private investment firm. Prior to joining the Quadrangle Group in August 2007, Mr. Rosensweig served as Chief Operating Officer of Yahoo! Inc., which he joined in April 2002. Prior to joining Yahoo!, Mr. Rosensweig was President of CNET Networks, Inc., an interactive media company, which he joined in October 2000. Mr. Rosensweig served for 18 years with Ziff-Davis, LLC, an integrated media and marketing services company, including roles as President and Chief Executive Officer of its subsidiary ZDNet, from 1997 until 2000 when ZDNet was acquired by CNET. Mr. Rosensweig holds a B.A. in Political Science from Hobart College.

As a result of his current executive position at Chegg.com, as well as his former positions as a senior executive at global media and technology organizations, Mr. Rosensweig provides the Board with extensive and relevant executive leadership, worldwide operations and technology industry experience.

|

| | | | | | | | | | | | John Warnock Co-Founder

| | Age: 81

Director since 1983.

Other Public Company Boards:

Salon Media Group, Inc. (2001 to 2017)

| | Committees: None

| | | | | Biography:

Dr. Warnock was a founder of Adobe and was our Chairman of the Board from April 1989 to January 2017. From September 1997 to January 2017, he shared the position of Chairman with Dr. Geschke. Dr. Warnock served as our Chief Executive Officer from 1982 until December 2000. From December 2000 until his retirement in March 2001, Dr. Warnock served as our Chief Technical Officer. Dr. Warnock holds a Ph.D. in Electrical Engineering, an M.S. in Mathematics and a B.S. in Mathematics and Philosophy from the University of Utah.

As a co-founder of Adobe and its former Chief Executive Officer, Chief Technical Officer and Chairman of the Board, Dr. Warnock has experience growing Adobe from a start-up to a large publicly traded company. His nearly 20 years of executive and technological leadership at Adobe provide the Board with significant leadership, operations and technology experience, as well as important perspectives on innovation, management development and global challenges and opportunities. As former Co-Chairman of the Board and Chairman of the board of Salon Media Group Inc., Dr. Warnock has a strong understanding of his role as a director and a broad perspective on key industry issues and corporate governance matters.

|

14| Adobe Inc.8

IndependenceCorporate Governance Framework

We have developed a corporate governance framework designed to ensure our Board has the appropriate practices in place to review and evaluate our business operations and to make decisions independent of Directors As required bymanagement. Our goal is to align the interests of directors, management and stockholders, and comply with or exceed the requirements of the Nasdaq listing standards, a majorityStock Market LLC (“Nasdaq”) and applicable laws and regulations. Adobe’s key governance documents, including our Corporate Governance Guidelines, are available at adobe.com/investor-relations/governance.html. See the section titled “Proxy Summary—Corporate Governance Highlights” for information on our corporate governance policies and practices.

Board Responsibilities and Structure The Board’s Role in Risk Oversight Risk assessment and oversight are an integral part of our governance and management processes. The Board is responsible for overseeing the development and execution of the Company’s strategic plans and for understanding the associated risks and actions that management is taking to manage and mitigate those risks. The Board believes that taking an active role in the oversight of Adobe’s corporate strategy and the related risks is appropriate, given our Board members’ combined breadth and depth of experience, and is critical to ensuring that the long-term interests of Adobe and its stockholders are being served. The Board also encourages management to promote a culture that actively manages risks as a part of Adobe’s corporate strategy and day-to-day business operations. Adobe’s management is responsible for developing and implementing the Company’s strategic plans and for identifying, evaluating, managing and mitigating the risks inherent in those plans through our risk management program. The scope of our Enterprise Risk Management (“ERM”) program includes a broad range of Adobe’s compliance, strategic, operational and financial risks. Throughout the year, members of oura cross-functional team within the Company conduct risk data collection, surveys and interviews of Company experts, leaders and specialists. From time to time, third-party experts are also consulted as part of this risk-assessment process. Together with the internal audit team, identified risks are then analyzed, categorized by topic (compliance, strategic, operational or financial) and timeframe (existing or emerging) and reported to management. For certain key risks, management action plans, whether current or planned, to mitigate identified risks are evaluated and updated as necessary. Annually, management presents and discusses the key risks identified in the ERM process with the Audit Committee and the full Board, must qualify as “independent,” as affirmatively determined by our Board. soliciting input from directors on the steps taken to mitigate risks and plans for additional mitigation in the year ahead. Our Board consults with our legal counseladministers this risk oversight function and is assisted by its standing committees to ensure that its determinations are consistent with all relevant securitiesaddress risks inherent in their respective areas of oversight and other laws and regulations regarding the definition of “independent,” including those set forthexpertise, as detailed in the applicable Nasdaq listing standards. In addition, in making its determination, the Board considers any arms-length transactions made in the ordinary course between Adobe and certain related entities, for instance the purchase from Adobetables below. | | | | | | | | | | | | | | | | | | | | | The Board | | | | | Our Board reviews the Company’s overall strategy, with annual reviews focused on the strategy of our various business units. On an annual basis, the Board reviews the Company’s key risks, including mitigation strategies, that are identified in the ERM process and also meets with the Chief Compliance Officer (the “CCO”), Chief Privacy and Cybersecurity Officer (the “CPCO”), Chief Security Officer (the “CSO”) and Chief Internal Audit Executive (the “CIAE”) to review existing and emerging risks. Additionally, the Board reviews the risk factors included in the Company’s annual reports filed with the SEC. | | | | | | |

Corporate Governance | 2024 Proxy Statement 9

After review of all relevant transactions and relationships between each director, any of their family members, Adobe, our executive officers and our independent registered public accounting firm, the Board has affirmatively determined that a majority of our Board is comprised of independent directors. Our current independent directors are: Ms. Banse, Mr. Biggs, Ms. Boulden, Mr. Calderoni, Ms. Desmond, Mr. Neumann, Ms. Oberg, Mr. Pandey, Mr. Ricks, Mr. Rosensweig and Dr. Warnock. During his term of service in fiscal year 2021, Mr. Daley was also determined to be an independent director. | | | | | | | | | | | | | | | | | | | | | The Committees | | | | | | | | | | Audit Committee | | | | | Our Audit Committee has primary responsibility for oversight of our ERM program, as well as oversight of particular risks, such as cybersecurity, privacy, information security and financial risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee monitors the effectiveness of our Code of Ethics for senior officers. The Audit Committee also monitors compliance with legal and regulatory requirements and oversees the performance of our internal audit function and of our independent registered public accounting firm. In carrying out this oversight, the Audit Committee receives or participates in: •frequent updates by the CCO, CPCO and CSO regarding key risks, including cybersecurity; •annual compliance updates regarding key compliance issues, as well as ongoing updates on developing risks, from the CCO, who reports to the general counsel and regularly interacts with and directly communicates with the Audit Committee; •annual meetings with the CCO without management present regarding key risks, issues or concerns; •quarterly meetings without management present with the CIAE, who reports to the Audit Committee, regarding key risks, issues or concerns; •annual review of the Company’s key risks, including mitigation strategies, identified in the ERM process; and •quarterly reviews of the risk factors included in the Company’s quarterly and annual reports filed with the SEC. | | | | | | | | | | | | | Executive Compensation Committee | | | | | Our Executive Compensation Committee oversees risks associated with our compensation programs, plans, policies and practices and HCM, diversity and inclusion strategy and programs, and assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. | | | | | | | | | | | | | Governance and Sustainability Committee | | | | | Our Governance and Sustainability Committee monitors the effectiveness of our Corporate Governance Guidelines, and approves or disapproves any related-persons transactions. Additionally, our Governance and Sustainability Committee oversees risks associated with ESG matters, other than HCM, and receives an annual update from management on the Company’s sustainability efforts and related risks. | | | | | | | | | | | |

Board Leadership Structure Each year, our Board evaluates whether its leadership structure is appropriate to effectively address the specific needs of our business and the long-term interests of our stockholders. Given the dynamic and competitive environment in which Adobe operates, the Board believes that Adobe and our stockholders are best served by a ChairmanChair who has broad and deep knowledge of Adobe’s business operations and the competitive landscape, the ability to identify strategic issues and the vision to create sustainable long-term value for stockholders. Based on these considerations, the Board has determined that, at this time, our Chief Executive Officer, Shantanu Narayen, is the director best qualified to serve in the role of Chairman.Chair. The Board believes that Mr. Narayen’s combined role enables decisive leadership, ensures clear accountability and enhances the Board’s ability to focus its meetings on the issues most critical to Adobe’s success as well as Adobe’s ability to communicate its message and strategy clearly and consistently to its stockholders, employees and customers. To maintain an appropriate level of independent checks and balances, our Corporate Governance Guidelines provide that if the ChairmanChair of the Board and the Chief Executive Officer are the same person, the independent members of the Board will annually select an independent director to serve in a lead capacity, who we refer to as our Lead Director. Our 10

Board believes that there are advantages to having a Lead Director for matters such as communications and relations among our Board, the Chief Executive Officer and other members of senior management and in assisting our Board in reaching consensus on particular strategies and policies. The independent members of our Board have selected Frank Calderoni to serve as Lead Director. The Board believes that from Mr. Calderoni’s experience as a director of several public companies, as well as serving as Chief Executive Officer of Velocity Global and his past experience as Chief Executive Officer of Anaplan, Inc. and Chief Financial Officer of Red Hat, Inc., Cisco Systems, Inc., QLogic Corporation and SanDisk Corporation, he brings abundant financial expertise and business acumen that helps ensure strong and independent oversight and effective collaboration among the directors. Our Lead Director coordinates the activities of the other independent directors and has the following additional responsibilities, as outlined in the Lead Director Charter adopted by the Board and available on our website at http://www.adobe.com/adobe.com/investor-relations/governance.html: •presiding at all meetings of the Board at which the ChairmanChair is not present, including executive sessions of the independent directors; •working to optimize Board performance through regular feedback that ensures that diverse viewpoints of all directors are heard and creating a climate of constructive candor in which frank and thoughtful discussion occurs; •meeting with the ChairmanChair and Chief Executive Officer to discuss Board agendas, materials and the schedule of meetings; •calling meetings of the independent directors, as needed; •retaining outside advisors and consultants who report directly to the Board on board-wideBoard-wide issues, as needed; •providing feedback to directors in connection with the periodic Board evaluation process; •administering, with the Chair of the Executive Compensation Committee, the Board’s evaluation of the performance of the ChairmanChair and Chief Executive Officer; and